Greece’s bail-out

Still tightly monitored

International creditors remain sceptical about Greece’s ability to reform without close supervision

TOURISTS dived for cover beneath restaurant tables as shooting broke out in Monastiraki, a crowded neighbourhood in Athens, on July 16th. Greek anti-terrorist police had trailed Nikos Maziotis, one of the country’s most wanted fugitives, to a shop selling camping equipment. As he fled, Mr Maziotis opened fire with a handgun. He was arrested after being shot in the shoulder by a police officer.

Appearing before an investigating judge, Mr Maziotis said his job was “being a revolutionary”. He is accused of belonging to Revolutionary Struggle, a leftist extremist group that claimed responsibility for staging a rocket attack against the American embassy in Athens in 2007 and for several car-bomb explosions. The most recent, outside the IMF office in Athens in April, came at a time when Greece took another step towards recovery, issuing its first sovereign bond since 2010.

Athens is enjoying its best year for tourism since it staged the summer Olympics in 2004. Fortunately, the shoot-out in Monastiraki was quickly over. “If there had been serious casualties, bookings would have been cancelled across the board. It goes to show how fragile the tourist industry is,” says Panos Asimacopoulos, a travel agent in Athens.

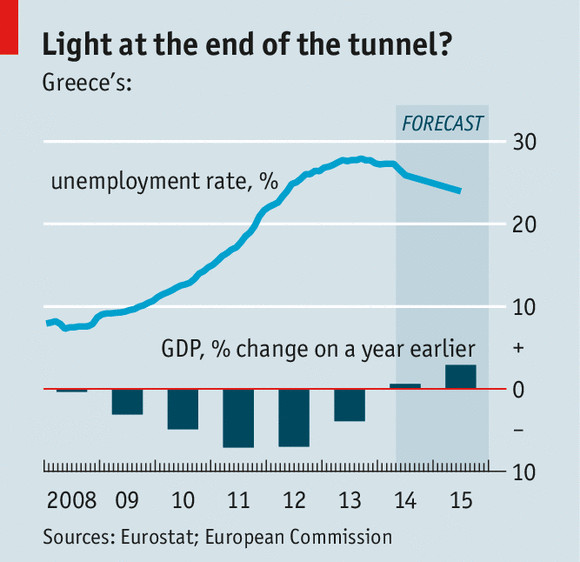

The Greek recovery is similarly frail. After a record 24 quarters of negative growth, the economy is forecast to grow by almost 1% this year. About 20,000 new jobs will be added over the summer, according to the National Bank of Greece, reversing six years of declining employment.

Business-confidence indicators are at a six-year high and consumers are again flocking to Athens’s shopping malls. The finance ministry says Greece is on track to hit this year’s target of a budget surplus, before interest payments, of 1.5% of GDP.

Even so, dozens of small but significant structural reforms are lagging behind schedule. Greek officials look forward with trepidation to the return in September of the troika, officials from the EU and IMF who supervise the country’s €172 billion ($231.5 billion) bail-out. It will be their final joint review of progress: the EU loan programme ends this year although the IMF plans to disburse another €16 billion in 2015 and the first quarter of 2016.

Negotiations will be tough. The Greeks want to ease the burden on hard-pressed taxpayers by reducing levies on fuel and, perhaps, by fudging an important reform that involves the large-scale dismissal of public-sector workers, which is fiercely opposed by the PanHellenic Socialist Movement, the junior partner in the fractious coalition government led by the centre-right New Democracy party of Antonis Samaras, the prime minister. Another round of painful pension cuts is looming, on top of earlier across-the-board reductions averaging 30%.

The newish finance minister, Gikas Hardouvelis, an America-trained economist, wants to slash the troika’s list of some 700 reforms to be enacted by the end of this year, arguing that such micromanagement is no longer required. With the unpopular “memorandum” (as the bail-out programme is called by Greeks) on its way out, it is time, according to Greek officials, for Athens to assume ownership of the next stage of reform. They argue that six years of exacting adjustment are starting to show results, so Greeks are now readier to accept changes that could ensure them a prosperous future. Outsiders are not so sure. They fear that without the troika’s rigorous oversight, tax collection will slow, public-sector reform will be dropped and spending controls relaxed.

Next year’s budget will be included in the current EU programme, making slippage less likely for the moment. Debt-relief negotiations, due to start at the end of the year, may also offer an opportunity for Greece’s euro-zone partners, the biggest creditors, to set conditions. Greece is seeking longer maturities and fixed rather than floating interest rates on its mountainous debt, set to reach 180% of GDP this year. The troika, much disliked by Greeks, may disappear but tight surveillance of Greek progress will not.

No comments:

Post a Comment

Please leave a comment-- or suggestions, particularly of topics and places you'd like to see covered