ROBERT B. REICH, Chancellor’s Professor of Public Policy at the University of California at Berkeley and Senior Fellow at the Blum Center for Developing Economies, was Secretary of Labor in the Clinton administration. Time Magazine named him one of the ten most effective cabinet secretaries of the twentieth century. He has written thirteen books, including the best sellers “Aftershock" and “The Work of Nations." His latest, "Beyond Outrage," is now out in paperback. He is also a founding editor of the American Prospect magazine and chairman of Common Cause. His new film, "Inequality for All," is now available on Netflix, iTunes, DVD, and On Demand.

ROBERT B. REICH, Chancellor’s Professor of Public Policy at the University of California at Berkeley and Senior Fellow at the Blum Center for Developing Economies, was Secretary of Labor in the Clinton administration. Time Magazine named him one of the ten most effective cabinet secretaries of the twentieth century. He has written thirteen books, including the best sellers “Aftershock" and “The Work of Nations." His latest, "Beyond Outrage," is now out in paperback. He is also a founding editor of the American Prospect magazine and chairman of Common Cause. His new film, "Inequality for All," is now available on Netflix, iTunes, DVD, and On Demand. + FOLLOW ON TUMBLR + TWITTER + FACEBOOK

#12. MOST IMPORTANT OF ALL: GET BIG MONEY OUT OF POLITICS

Over the past two months, the videos I’ve done with MoveOn.org have detailed several ways to make the economy work for the many, not the few: raising the minimum wage to $15 an hour, making public higher education free, busting up the big banks, expanding Social Security, making polluters pay, raising the estate tax, strengthening unions, ending corporate welfare, helping families succeed economically, and letting all Americans buy into Medicare.

But none of these is possible if we don’t get big money out of politics.

In fact, nothing we need to do as a nation is possible unless we limit the political power of the moneyed interests.

So we made one more video – the one accompanying this post – and it’s incredibly important you share this one, too.

At the rate we’re going, the 2016 election is likely to be the most expensive in history – and the moneyed interests will be responsible for most of it. Our democracy is broken, and we must fix it.

Easy to say, but how do we do it?

First and most immediately, require full disclosure of all original sources of campaign money – so the public knows who’s giving what to whom, and can hold politicians accountable if they do favors for contributors while neglecting their responsibilities to all of us.

If Congress won’t enact a law requiring such full disclosure, the Federal Election Commission has the power to do it on its own and the SEC can do it for public corporations – which, by the way, are major campaign spenders.

Meanwhile, the President should issue an executive order requiring all federal contractors to fully disclose their political contributions. There’s a growing movement to encourage him to do just that.

Next, our government should provide matching funds for small-donor contributions – say $3 in public dollars for every $1 dollar from a small donor. Those public dollars could come from a check-off on your income tax return indicating you want, say, $15 of your taxes devoted to public financing of elections.

Third and most importantly, we must reverse the Supreme Court’s 5-4 First Amendment decisions holding that money is speech and corporations have the political rights of people – and that therefore no laws can be enacted limiting the amount of money wealthy individuals or big corporations can spend on elections.

We have to work hard for a constitutional amendment to overturn “Citizen’s United” – with the understanding that we’ll either succeed in amending our Constitution, or we’ll build a social movement powerful enough to influence the Supreme Court, just like the movement that led to the historic “Brown v. the Board of Education” decision.

Ultimately we need Supreme Court justices who understand that the freedom of speech of most Americans is drowned out when big money can spend as much as it wants, to be as loud as it needs to be.

The fundamental rule for an economy that works for everyone is a democracy that works, period.

#11. WHY MEDICARE ISN’T THE PROBEM; IT’S THE SOLUTION

Again and again the upcoming election you’ll hear conservatives claim that Medicare - the health insurance program for America’s seniors - is running out of money and must be pared back.

Baloney. Medicare isn’t the problem. In fact, Medicare is more efficient than private health insurance.The real problem is that the costs of health care are expected to rise steeply.

Medicare could be the solution – the logical next step after the Affordable Care Act toward a single-payer system.

Please see the accompanying video – #11 in our series on ideas to make the economy work for the many rather than for the few. And please share.

Some background: Medicare faces financial problems in future years because of two underlying trends that will affect all health care in coming years, regardless of what happens to Medicare:

The first is that healthcare costs are rising overall - not as fast as they were rising before the Affordable Care Act went into effect, but still rising too quickly.

The second is that the giant postwar baby boom is heading toward retirement and older age. Which means more elderly people will need more health care, adding to the rising costs.

So how should we deal with these two costly trends? By making Medicare available to all Americans, not just the elderly.

Remember, Medicare is more efficient than private health insurers whose administrative costs and advertising and marketing expenses are eating up billions of dollars each year.

If more Americans were allowed to join Medicare, it could become more efficient by using its growing bargaining power to get lower drug prices, lower hospital bills, and healthier people.

Allowing all Americans to join Medicare is the best way to control future healthcare costs while also meeting the needs of the baby boomer and other Americans.

Everyone should be able to sign up for Medicare on the healthcare exchanges set up under the Affordable Care Act.This would begin to move America away from its reliance on expensive private health insurance, and toward Medicare for all – a single payer system.

Medicare isn’t a problem. It’s part of the solution.

How to Punish Bank Felons

SATURDAY, JUNE 20, 2015

What exactly does it mean for a big Wall Street bank to plead guilty to a serious crime? Right now, practically nothing.

But it will if California’s Santa Cruz County has any say.

First, some background.

Five giant banks – including Wall Street behemoths JPMorgan Chase and Citicorp – recently pleaded guilty to criminal felony charges that they rigged the world’s foreign-currency market for their own profit.

This wasn’t a small heist. We’re talking hundreds of billions of dollars worth of transactions every day.

The banks altered currency prices long enough for the banks to make winning bets before the prices snapped back to what they should have been.

Attorney General Loretta Lynch called it a “brazen display of collusion” that harmed “countless consumers, investors and institutions around the globe — from pension funds to major corporations, and including the banks’ own customers.”

The penalty? The banks have agreed to pay $5.5 billion. That may sound like a big chunk of change, but for a giant bank it’s the cost of doing business. In fact, the banks are likely to deduct the fines from their taxes as business costs.

The banks sound contrite. After all, they can’t have the public believe they’re outright crooks.

It’s “an embarrassment to our firm, and stands in stark contrast to Citi’s values,“ says Citigroup CEO Michael Corbat.

Values? Citigroup’s main value is to make as much money as possible. Corbat himself raked in $13 million last year.

JPMorgan CEO Jamie Dimon calls it "a great disappointment to us,” and says “we demand and expect better of our people.”

Expect better? If recent history is any guide – think of the bank’s notorious “London Whale” a few years ago, and, before that, the wild bets leading to the 2008 bailout – JPMorgan expects exactly this kind of behavior from its people.

Which helped Dimon rake in $20 million last year, as well as a $7.4 million cash bonus.

When real people plead guilty to felonies, they go to jail. But big banks aren’t people despite what the five Republican appointees to the Supreme Court say.

The executives who run these banks aren’t going to jail, either. Apologists say it’s not fair to jail bank executives because they don’t know what their rogue traders are up to.

Yet ex-convicts often suffer consequences beyond jail terms.

In many states they lose their right to vote. They can’t run for office or otherwise participate in the political process.

So why not take away the right of these convicted banks to participate in the political process, at least for some years? That would stop JPMorgan’s Dimon from lobbying Congress to roll back the Dodd-Frank act, as he’s been doing almost non-stop.

Why not also take away their right to pour money into politics? Wall Street banks have been among the biggest contributors to political campaigns. If they’re convicted of a felony, they should be barred from making any political contributions for at least ten years.

Real ex-convicts also have difficulty finding jobs. That’s because, rightly or wrongly, many people don’t want to hire them.

A strong case can be made that employers shouldn’t pay attention to criminal convictions of real people who need a fresh start, especially a job.

But giant banks that have committed felonies are something different. Why shouldn’t depositors and investors consider their past convictions?

Which brings us to Santa Cruz County.

The county’s board of supervisors just voted not to do business for five years with any of the five banks felons.

The county won’t use the banks’ investment services or buy their commercial paper, and will pull its money out of the banks to the extent it can.

“We have a sacred obligation to protect the public’s tax dollars and these banks can’t be trusted. Santa Cruz County should not be involved with those who rigged the world’s biggest financial markets,” says supervisor Ryan Coonerty.

The banks will hardly notice. Santa Cruz County’s portfolio is valued at about $650 million.

But what if every county, city, and state in America followed Santa Cruz County’s example, and held the big banks accountable for their felonies?

What if all of us taxpayers said, in effect, we’re not going to hire these convicted felons to handle our public finances? We don’t trust them.

That would hit these banks directly. They’d lose our business. Which might even cause them to clean up their acts.

There’s hope. Supervisor Coonerty says he’ll be contacting other local jurisdictions across the country, urging them to do what Santa Cruz County is doing.

#10. END MASS INCARCERATION NOW

Imprisoning a staggering number of our people is wrong. The way our nation does it is even worse. We must end mass incarceration, now.

If I'm walking down the street with a Black or Latino friend, my friend is way more likely to be stopped by the police, questioned, and even arrested. Even if we're doing the exact same thing—he or she is more likely to be convicted and sent to jail.

Unless we recognize the racism and abuse of our criminal justice system and tackle the dehumanizing stereotypes that underlie it, our nation – and our economy – will never be as strong as it could be.

Please take a moment to watch the accompanying video, and please share it so others can understand what’s at stake for so many Americans.

Here are the facts:

Today, the United States has 5 percent of the world’s population, but has 25 percent of its prisoners, and we spend more than $80 billion each year on prisons.

The major culprit is the so-called War on Drugs. There were fewer than 200,000 Americans behind bars as recently as the mid-70’s. Then, a racially-tinged drug hysteria swept our nation, and we saw a wave of increasingly militant policing that targeted communities of color and poorer neighborhoods.

With “mandatory minimums” and “three strikes out” laws, the number of Americans behind bars soon ballooned to nearly 2.5 million today, despite widespread evidence that locking people up doesn't make us safer.

Unconscious bias and cultural stereotypes lead to discriminatory enforcement of the laws – from who gets pulled over to where police conduct drug sweeps.

Even though Blacks, whites, and Latinos use drugs at similar rates, people with black and brown skin are more likely to be pulled over, searched, arrested, charged with a crime, convicted, and sent to jails and prisons where they can be subject to some of the worst human rights abuses.

As a result, black people incarcerated at a rate five times that of whites, and Latinos incarcerated at a rate double that of white Americans.

Even if you’ve “served your time,” you never escape the label.

A felony conviction can bar you from getting a student loan, putting a roof over your head, or even from voting. It might even disqualify you from getting a job which can make it impossible for people with felony convictions to pull themselves out of poverty. And many who end up in prison were living in chronic poverty to begin with.

All of this means a lot of potential human talent is going to waste. We’re spending a fortune locking people up who could fuel our economy and build strong communities, in some cases just to increase the profits of private prison corporations.

So what do we do?

First, enact smarter sentencing laws that end mandatory minimums and transform the way we treat people who enter the criminal justice system. Instead of prisons and jails, we need well-paying jobs, and to invest in proven and cost-effective alternatives to incarceration, like job training and mental health and drug treatment programs.

Second, stop the militarized policing and end discriminatory policing practices such as "stop and frisk" and "broken windows" that disproportionately target communities of color.

Third, stop building new jails, start closing some existing ones, and begin to invest in schools, public transit, and housing assistance or local jobs programs. States are spending more and more on prisons, while cutting funding for schools. That’s crazy.

Finally, “ban the box” – the box on job applications that asks whether you have ever been convicted of a felony on a job application. Already, dozens of states cities, and counties have passed bills requiring that employers consider what you can do in the future, not what you might have done in the past.

Instead of locking people up unjustly, and then locking them out of the economy for the rest of their lives, we need to stop wasting human talent and start opening doors of opportunity – to everyone.

Why the Trans Pacific Partnership is Nearly Dead

SUNDAY, JUNE 14, 2015

How can it be that the largest pending trade deal in history – a deal backed both by a Democratic president and Republican leaders in Congress – is nearly dead?

The Trans Pacific Partnership may yet squeak through Congress but its near-death experience offers an important lesson.

It’s not that labor unions have regained political power (union membership continues to dwindle and large corporations have more clout in Washington than ever) or that the President is especially weak (no president can pull off a major deal like this if the public isn’t behind him).

The biggest lesson is most Americans no longer support free trade.

It used to be an article of faith that trade was good for America.

Economic theory told us so: Trade allows nations to specialize in what they do best, thereby fueling growth. And growth, we were told, is good for everyone.

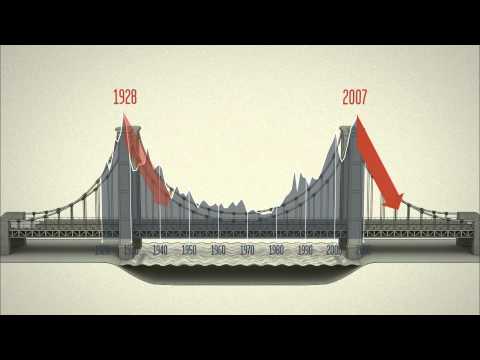

But such arguments are less persuasive in this era of staggering inequality.

For decades almost all the gains from growth have been going to a small sliver of Americans at the top – while most peoples’ wages have stagnated, adjusted for inflation.

Economists point to overall benefits from expanded trade. All of us gain access to cheaper goods and services.

But in recent years the biggest gains from trade have gone to investors and executives, while the burdens have fallen disproportionately on those in the middle and below who have lost good-paying jobs.

So even though everyone gains from trade, the biggest winners are at the top. And as the top keeps moving higher compared to most of the rest of us, the vast majority feels relatively worse off.

To illustrate the point, consider a simple game I conduct with my students. I have them split up into pairs and ask them to imagine I’m giving $1,000 to one member of each pair.

I tell them the recipients can keep some of the money only on condition they reach a deal with their partner on how it’s to be divided up. They have to offer their partner a portion of the $1,000, and their partner must either accept or decline. If the partner declines, neither of them gets a penny.

You might think many recipients of the imaginary $1,000 would offer their partner one dollar, which the partner would gladly accept. After all, a dollar is better than nothing. Everyone is better off.

But that’s not what happens. Most partners decline any offer under $250 – even though that means neither of them gets anything.

This game, and variations of it, have been played by social scientists thousands of times with different groups and pairings, and with remarkably similar results.

A far bigger version of the game is being played on the national stage as a relative handful of Americans receive ever-larger slices of the total national income while most Americans, working harder than ever, receive smaller ones.

And just as in the simulations, those receiving the smaller slices are starting to say “no deal.”

Some might attribute this response to envy or spite. But when I ask my students why they refused to accept anything less than $250 and thereby risked getting nothing at all, they say it’s worth the price of avoiding unfairness.

Remember, I gave out the $1,000 arbitrarily. The initial recipients didn’t have to work for it or be outstanding in any way.

When a game seems arbitrary, people are often willing to sacrifice gains for themselves in order to prevent others from walking away with far more – a result that strikes them as inherently wrong.

The American economy looks increasingly arbitrary, as CEOs of big firms now rake in 300 times more than the wages of average workers, while two-thirds of Americans live paycheck to paycheck.

Some of my students who refused anything less than $250 also say they feared allowing the initial recipient to keep a disproportionately large share would give him the power to rig the game even more in the future.

Here again, America’s real-life distributional game is analogous, as a few at the top gain increasing political power to alter the rules of the game to their advantage.

If the American economy continues to create a few big winners and many who feel like losers by comparison, free trade won’t be the only casualty.

Losers are likely to find many other ways to say “no deal.”

#9. MAKE POLLUTERS PAY US

Instead of investing in dirty fuels, let’s start charging polluters for poisoning our skies – and then invest the revenue so that it benefits everyone.

Each ton of carbon that’s released into the atmosphere costs our nation between $40 and $100, and we release millions tons of it every year.

Businesses don’t pay that cost. They pass it along to the rest of us—in the form of more extreme weather and all the costs to our economy and health resulting from it.

We’ve actually invested more than $6 trillion in fossil fuels since 2007. The money has been laundered through our savings and tax dollars.

This has got to be reversed.

We can clean our environment and strengthen the economy if we (1) divest from carbon polluters, (2) make the polluters pay a price to pollute, and (3) then collect the money.

Please see the accompanying video, and share.

Anticipatory Bribery

SUNDAY, JUNE 7, 2015

Washington has been rocked by the scandal of J. Dennis Hastert, the longest-serving Republican speaker in the history of the U.S. House, indicted on charges of violating banking laws by paying $1.7 million (as part of a $3.5 million agreement) to conceal prior misconduct, allegedly child molestation.

That scandal contains another one that’s received less attention: the fact that Hastert, who never made much money as a teacher or a congressman, could manage such payments because after retiring from Congress he became a high-paid lobbyist.

This second scandal is perfectly legal but it’s a growing menace.

In the 1970s, only 3 percent of retiring members of Congress went on to become Washington lobbyists. Now, half of all retiring senators and 42 percent of retiring representatives become lobbyists.

This isn’t because more recent retirees have had fewer qualms. It’s because the financial rewards from lobbying have mushroomed, as big corporations and giant Wall Street banks have sunk fortunes into rigging the game to their advantage.

In every election cycle since 2008, more money has gone into lobbying at the federal level than into political campaigns. And an increasing portion of that lobbying money has gone into the pockets of former members of Congress.

In viewing campaign contributions as the major source of corruption we overlook the more insidious flow of direct, personal payments – much of which might be called “anticipatory bribery” because they enable office holders to cash in big after they’ve left office.

For years, former Republican House majority leader Eric Cantor was one of Wall Street’s strongest advocates – fighting for the bailout of the Street, to retain the Street’s tax advantages and subsidies, and to water down the Dodd-Frank financial reform legislation.

Just two weeks after resigning from the House, Cantor joinedthe Wall Street investment bank of Moelis & Co., as vice chairman and managing director, starting with a $400,000 base salary, $400,000 initial cash bonus, and $1 million in stock.

As Cantor explained, “I have known Ken [the bank’s CEO] for some time and … followed the growth and success of his firm.”

Exactly. They had been doing business together so long that Cantor must have anticipated the bribe.

Anticipatory bribery undermines trust in government almost as much as direct bribery. At a minimum, it can create the appearance of corruption, and raise questions in the public’s mind about the motives of public officials.

Was the Obama White House so easy on big Wall Street banks – never putting tough conditions on them for getting bailout money or prosecuting a single top Wall Street executive – because Tim Geithner, Barack Obama’s treasury secretary, and Peter Orszag, his director of the Office of Management and Budget, anticipated lucrative jobs on the Street? (Geithner became president of the private-equity firm Warburg Pincus when he left the administration; Orszag became Citigroup’s vice chairman for global banking.)

Another form of anticipatory bribery occurs when the payment comes in anticipation of a person holding office, and then delivering the favors.

According to the New York Times, as Marco Rubio ascended the ranks of Republican politics, billionaire Norman Braman not only bankrolled his campaigns but subsidized Rubio’s personal finances.

A case of anticipatory bribery? Certainly looks like it. In the Florida legislature, Rubio steered taxpayer funds to Braman’s favored causes, including an $80 million state grant to finance a genomics center at a private university and $5 million for cancer research at a Miami institute. “When Norman Braman brings [a proposal] to you,” Rubio said, “you take it seriously.”

Hillary and Bill Clinton have made more than $25 million for 104 speeches since the start of last year, according to disclosure forms filed with the Federal Election Commission in mid May – of which she delivered 51, earning more than $11 million of the total.

Now that she’s running for president, she’s stopped giving paid speeches. But her husband says he intends to continue. “I gotta pay our bills,” he told NBC News.

Anticipatory bribery? Asked about his paid speeches, some of which pay $500,000 or more, Bill Clinton said, “People like to hear me speak.”

That may be the reason for the hefty fees, but is it possible that some portion comes in anticipation his having the intimate ear of the next president?

We need some rules here.

First, former government officials, including members of Congress, shouldn’t be able to lobby or take jobs in industries over which they had some oversight, for at least three years after leaving office.

Second, anyone who runs for office should bear the burden of showing that whatever personal payments they received up to three years before were based on their economic worth, not anticipated political clout.

Finally, once they declare, even their spouses should desist from collecting big bucks that could look like anticipatory bribes.

#8. RAISE THE ESTATE TAX ON THE VERY RICH

At a time of historic economic inequality, it should be a no-brainer to raise a tax on inherited wealth for the very rich. Yet there’s a move among some members of Congress to abolish it altogether.

If you’re as horrified at the prospect of abolishing the estate tax as I am, I hope you’ll watch and share the accompanying video.

Today the estate tax reaches only the richest two-tenths of one percent, and applies only to dollars in excess of $10.86 million for married couples or $5.43 million for individuals.

That means if a couple leaves to their heirs $10,860,001, they now pay the estate tax on $1. The current estate tax rate is 40%, so that would be 40 cents.

Yet according to these members of Congress, that’s still too much.

Abolishing the estate tax would give each of the wealthiest two-tenths of 1 percent of American households an average tax cut of $3 million, and the 318 largest estates would get an average tax cut of $20 million.

It would also reduce tax revenues by $269 billion over ten years. The result would be either larger federal deficits or higher taxes on the rest of us to fill the gap.

This is nuts. The richest 1 percent of Americans now have 42 percent of the nation’s entire wealth, while the bottom 90 percent has just 23 percent.

That’s the greatest concentration of wealth at the top than at any time since the Gilded Age of the 1890s.

Instead of eliminating the tax on inherited wealth, we should increase it – back to the level it was in the late 1990s. The economy did wonderfully well in the late 1990s, by the way.

Adjusted for inflation, the estate tax restored to its level in 1998 would begin to touch estates valued at $1,748,000 per couple.

That would yield approximately $448 billion over the next ten years – way more than enough to finance ten years of universal preschool and two free years of community college for all eligible students.

Our democracy’s Founding Fathers did not want a privileged aristocracy. Yet that’s the direction we’re going in. The tax on inherited wealth is one of the major bulwarks against it. That tax should be increased and strengthened.

It’s time to rein in America’s surging inequality. It’s time to raise the estate tax.

State of Disaster

SUNDAY, MAY 31, 2015

As extreme weather marked by tornadoes and flooding continues to sweep across Texas, Gov. Greg Abbott has requested – and President Obama has granted – federal help.

I don’t begrudge Texas billions of dollars in disaster relief. After all, we’re all part of America. When some of us are in need, we all have a duty to respond.

But the flow of federal money poses a bit of awkwardness for the Lone Star State.

After all, just over a month ago hundreds of Texans decided that a pending Navy Seal/Green Beret joint training exercise was really an excuse to take over the state and impose martial law. And they claimed the Federal Emergency Management Agency was erecting prison camps, readying Walmart stores as processing centers for political prisoners.

There are nut cases everywhere, but Texas’s governor, Greg Abbott added to that particular outpouring of paranoia by ordering the Texas State Guard to monitor the military exercise. “It is important that Texans know their safety, constitutional rights, private property rights and civil liberties will not be infringed upon,” he said. In other words, he’d protect Texans from this federal plot.

Now, Abbott wants federal money. And the Federal Emergency Management Agency is gearing up for a major role in the cleanup – including places like Bastrop, Texas, where the Bastrop State Park dam failed – and where, just five weeks ago, a U.S. Army colonel trying to explain the pending military exercise was shouted down by hundreds of self-described patriots shouting “liar!”

Texans dislike the federal government even more than most other Americans do. According to a February poll conducted by the University of Texas and the Texas Tribune, only 23 percent of Texans view the federal government favorably, while 57 percent view it unfavorably, including more than a third who hold a “very unfavorable” view.

Texas dislikes the federal government so much that eight of its congressional representatives, along with Senator Ted Cruz, opposed disaster relief for the victims of Hurricane Sandy – adding to the awkwardness of their lobbying for the federal relief now heading Texas’s way.

Yet even before the current floods, Texas had received more disaster relief than any other state, according to a study by the Center for American Progress. That’s not simply because the state is so large. It’s also because Texas is particularly vulnerable to extreme weather – tornadoes on the plains, hurricanes in the Gulf, flooding across its middle and south.

Given this, you might also think Texas would take climate change especially seriously. But here again, there’s cognitive dissonance between what the state needs and how its officials act.

Among Texas’s infamous climate-change deniers is Lamar Smith, chairman of the House Committee on Science, Space, and Technology, who dismissed last year’s report by the United Nations’ Intergovernmental Panel on Climate Change as “more political than scientific,“ and the White House report on the urgency of addressing climate change as designed “to frighten Americans.”

Smith is still at it. His committee just slashed by more than 20 percent NASA’s spending on Earth science, which includes climate change.

Smith is still at it. His committee just slashed by more than 20 percent NASA’s spending on Earth science, which includes climate change.

It’s of course possible that Texas’s current record rainfalls – the National Weather Service reports that the downpour in May alone was enough to put the entire state under eight inches of water – has nothing to do with the kind of extreme weather we’re witnessing elsewhere in the nation, such as the West’s current drought, the North’s record winter snowfall, and flooding elsewhere.

But you’d have to be nuts not to be at least curious about such a connection, and its relationship to the carbon dioxide humans have been spewing into the atmosphere.

Consider also the consequences for the public’s health. Several deaths in Texas have been linked to the extreme weather. Many Texans have been injured by it, directly or indirectly. Poor residents are in particular peril because they live in areas prone to flooding or in flimsy houses and trailers that can be washed or blown away.

What’s Texas’s response? Texas officials continue to turn down federal funds to expand Medicaid under the Affordable Care Act, thereby denying insurance to more than 1 million people and preventing the state from receiving an estimated $100 billion in federal cash over the next decade.

I don’t want to pick on Texas. Its officials are not alone in hating the federal government, denying climate change, and refusing to insure its poor.

And I certainly don’t want to suggest all Texans are implicated. Obviously, many thoughtful and reasonable people reside there.

Yet Texans have elected people who seem not to have a clue. Indeed, Texas has done more in recent years to institutionalize irrationality than almost anywhere else in America – thereby imposing a huge burden on its citizens.

How many natural disasters will it take for the Lone Star State to wake up to the disaster of its elected officials?

#7. STRENGTHEN UNIONS

One big reason America was far more equal in the 1950s and 1960s than now is unions were stronger then. That gave workers bargaining power to get a fair share of the economy’s gains – and unions helped improve wages and working conditions for everyone.

But as union membership has weakened – from more than a third of all private-sector workers belonging unions in the 1950s to fewer than 7 percent today – the bargaining power of average workers has all but disappeared.

In fact, the decline of the American middle class mirrors almost exactly the decline of American labor union membership.

So how do we strengthen unions?

First, make it easier to form a union, with a simple majority of workers voting up or down.

Right now, long delays and procedural hurdles give big employers plenty of time to whip up campaigns against unions, even threatening they’ll close down and move somewhere else if a union is voted in.

Second, build in real penalties on companies that violate labor laws by firing workers who try to organize a union or intimidating others.

These moves are illegal, but nowadays the worst that can happen is employers get slapped on the wrist. If found guilty they have to repay lost wages to the workers they fire. Some employers treat this as a cost of doing business. That must be stopped. Penalties should be large enough to stop this illegality.

Finally – this one has been in the news lately, and if you only remember one thing, remember this: We must enact a federal law that pre-empts so-called state “right-to-work” laws.

Don’t be fooled by the “right to work” name. These laws allow workers to get all the benefits of having a union without paying union dues. It’s a back door destroying unions. If no one pays dues, unions have no way to provide any union benefits. And that means lower wages.

In fact, wages in right-to-work states are lower on average than wages in non-right-to-work states, by an average of about $1500 a year. Workers in right-to-work states are also less likely to have employer-sponsored health insurance and pension coverage.

When unions are weakened by right-to-work laws, all of a state’s workers are hurt.

American workers need a union to bargain on their behalf. Low-wage workers in big-box retail stores and fast-food chains need a union even more.

If we want average Americans to get a fair share of the gains from economic growth, they need to be able to unionize.

No comments:

Post a Comment

Please leave a comment-- or suggestions, particularly of topics and places you'd like to see covered